AARP Hearing Center

The birthday cards were the first clues I failed to pick up on.

For years, my widower dad in North Carolina had sent me a generous birthday check that he enclosed in a flowery greeting card, always printed with a schmaltzy sentiment that he would never have expressed in person.

Then he suddenly started sending me (and my husband and two young daughters on their birthdays) the free cards you get in the mail as part of a fundraising appeal — sometimes with $5 inside. We didn’t need the cash (“We’re a two-income household, Dad,” I’d tell him. “I appreciate the gesture, but you don’t need to send us money”). But it was a noticeable departure from his usual practice.

Eventually, the cards stopped coming altogether. He’d phone our home in Michigan a few days after a birthday and apologize for forgetting to call or send a card. I’d tamp down my annoyance and hurt, chalking up Dad’s forgetfulness to aging.

But just before Thanksgiving 2020, when we were all quarantined in our homes, Dad mentioned during a call that he could only cover half of his property taxes (approximately $3,600), due at the start of 2021.

This seemed odd. A retired engineer, he’d paid his taxes every year before. And considering his adequate monthly income (an auto-industry pension plus a Social Security check) and that his home mortgage was paid off, he should have been able to pay the amount without a problem.

Join Our Fight Against Fraud

Here’s what you can do to help protect people 50 and older from scams and fraud:

- Sign up to become a digital fraud fighter to help raise awareness about the latest scams.

- Read more about how we’re fighting for you every day in Congress and across the country.

- AARP is your fierce defender on the issues that matter to people 50-plus. Become a member or renew your membership today.

When my husband, Joe, and I asked this frugal man, who’d lived his entire life making meticulous budget calculations, what was going on, Dad showed us a monthly budget sheet. It didn’t add up.

Joe works in a law firm specializing in bankruptcy, so I asked him to call my father and find out what was happening.

After reading my daughter to sleep later that night, I came down to the kitchen, where Joe was cleaning up from dinner.

“So your father…” Joe paused and sighed.

“You’re scaring me,” I said, gripping the table as I sat down.

“Your father is coming up short because he’s been paying $2,800 a month in rent for his girlfriend and her daughter, who was trying to become an actress in L.A.”

Girlfriend? What girlfriend? And how long had this arrangement been in place?

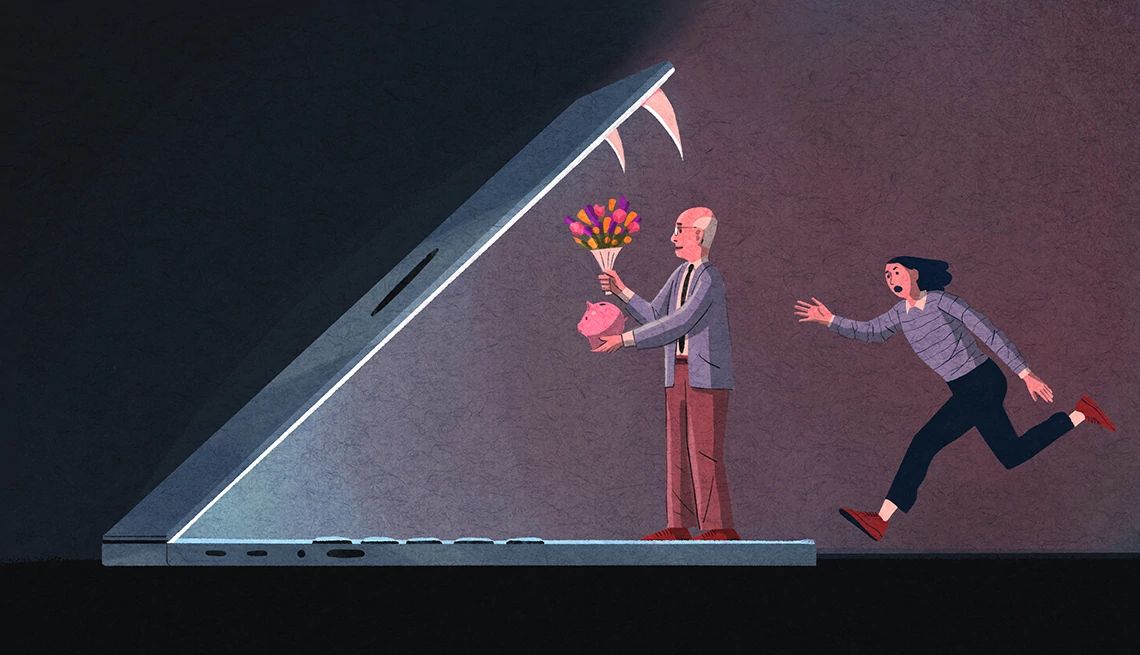

The news stunned me, but the truths we’d unearth in the days that followed would paint an even bleaker picture: My dad was deep in the throes of a long-running romance scam.

How the scam began

Nearly a decade before, in November 2011, my father emailed to tell me that he’d started dating Bobbie, a woman he’d met on a dating site who lived in a nearby town. (My mom had died of cancer in early 2009.) He said she worked at a post office and was 24 years younger than him (44 to his 68). The age disparity initially gave him pause, he wrote, but he liked her and wanted us to meet her during the holidays.

Skeptical family members ran a background check on Bobbie. They turned up several arrests for misdemeanors that included injury to personal property, simple assault and phone harassment. She was also twice divorced, and the second divorce had been finalized just months before she and my dad started interacting.

Though I argued that my dad could make his own decisions about his personal life (thus revealing my naivete), other family members urgently warned him against dating someone with that many red flags. He soon claimed he’d broken things off, so I eventually forgot about her — until that night in my kitchen, nine years later.

More From AARP

The Best Ways to Spot Catfishers Online

Scammers will use fake or stolen images to draw your interest

Beware of 'Love Bombers'

Extreme adoration at the start of a relationship should raise red flags

25 Effective Tips to Protect Against Scams

Safeguard yourself with these practical anti-fraud strategies